Dollar Cost Averaging

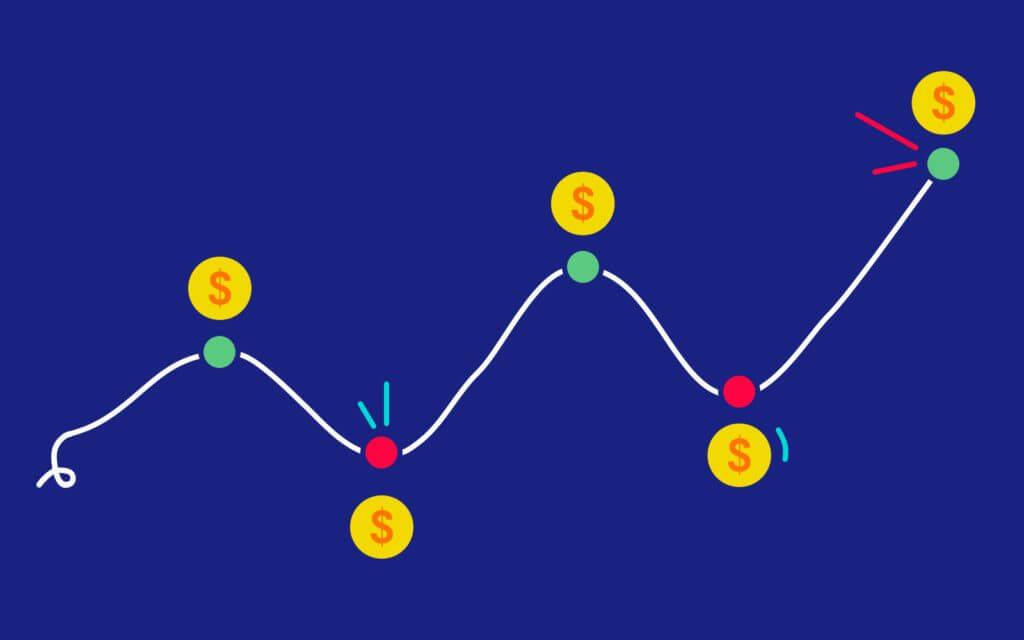

Dollar Cost Averaging can also be used to offset some of the risk associated with volatility in a particular investment, or in an overall portfolio. If this approach is implemented during a period where the investment experiences volatility, it can result in a higher average price per share than the average cost per share. Of course, that description doesn’t help us all that much, so let’s translate this into ‘human’ language through a hypothetical scenario:

To illustrate, let’s say that you bought $60,000 worth of stock in Company X on January 1st at $20 per share. When you check back in at the end of six months, the price of the stock is $14 per share. If you were to sell at that point, you would realize a loss of around 30% – or in other words, around $18,000.

Now, let’s say that instead, you made an initial investment of $10,000 and followed that up with additional purchases in $10,000 increments until you reached your full investment amount of $60,000. When we first glance at the end-of-month stock prices, the situation actually looks even worse. Those prices were: $20 (starting price), $16, $5, $12, $9, $13, and finally our end price of $14. That’s a lot of volatility! But… If we take a look at the number of shares we bought with each $10,000 investment, the situation starts to come into focus. The number of shares purchased each month were: 500, 625, 2000, 833, 1,111, and 769, respectively. That gives us a total of 5,838 shares. When we multiply that by our final stock price of $14, we are left with a market value of $81,732. That represents a roughly 36% increase over the total amount invested! You knew you were a genius for buying into Company X, and for the record, I believed in you the whole time….

Clients generally experience the most success Dollar Cost Averaging in the following two circumstances:

1.) When they don’t have a lump-sum dollar amount to invest – In this case, DCA is a great way to build in the discipline of regular contributions. It also helps some clients feel they can take on slightly more risk in their choice of investments early on.

2.) When they know their money should be invested according to their personal risk tolerance, but they also have significant concerns around the potential of a sharp, near-term decline in the market. Put another way, when they know they need to get from point ‘A’ (not invested) to point ‘B’ (invested), but they are struggling with how to get started, given their feelings about the market. In this situation, Dollar Cost Averaging into a diversified portfolio can be a particularly effective strategy.

If you would like to have a conversation around this or any other investing-related concepts, please feel free to reach out to us at the Heritage Wealth Management Group. As always, we’ll do whatever we can to advocate and to be of service.

Rhett Garner, CLU®, ChFC®, CFP® Vice President – Financial Advisor Heritage Wealth Management Group

This content is being provided for informational purposes only and should not be construed as financial, investment, tax, or legal advice. The views and opinions expressed do not necessarily reflect those of the company. Always consult a licensed investment professional before making investment decisions. All investments and financial strategies involve various risks, including the possibility of loss of principal. Investment values and returns will fluctuate. There are no implied guarantees or assurances that any target objectives will be met. Future performance may differ significantly from past performance due to many different factors. The Heritage Wealth Management Group, its employees, affiliates, and associated persons shall not be held liable for losses resulting from financial decisions based on information or viewpoints presented herein.